Overview of Decentralized Crypto Exchanges

Decentralized crypto exchanges are a type of cryptocurrency exchange that operates on a decentralized blockchain network, rather than a centralized server controlled by a single entity. This means that the exchange is not subject to the same risks of censorship, hacking, or fraud as centralized exchanges. Decentralized crypto exchanges offer a number of benefits over centralized exchanges, including:

Decentralized crypto exchanges are a type of cryptocurrency exchange that operates on a decentralized blockchain network, rather than a centralized server controlled by a single entity. This means that the exchange is not subject to the same risks of censorship, hacking, or fraud as centralized exchanges. Decentralized crypto exchanges offer a number of benefits over centralized exchanges, including: - Increased security: Decentralized exchanges are less susceptible to hacking and fraud because they do not store user funds on a central server.

- Greater transparency: Decentralized exchanges are typically more transparent than centralized exchanges because they are based on open-source software and operate on a public blockchain.

- More control: Decentralized exchanges give users more control over their funds because they are not subject to the same KYC/AML regulations as centralized exchanges.

Key Features of Decentralized Crypto Exchanges

Decentralized crypto exchanges (DEXs) offer a range of unique features that distinguish them from centralized exchanges (CEXs). These key features provide traders with greater control over their assets, enhanced security, and increased transparency.

Trustless Trading, Decentralized crypto exchange

DEXs operate on a peer-to-peer (P2P) network, eliminating the need for a trusted third party to facilitate trades. Instead, smart contracts govern the execution of trades, ensuring that both parties fulfill their obligations without the risk of counterparty default.

Non-Custodial Nature

Unlike CEXs, which hold users' assets in their own custody, DEXs do not take possession of traders' funds. Instead, users retain full control over their private keys, granting them complete autonomy over their assets and eliminating the risk of exchange-based hacks or misappropriation of funds.

Security and Transparency

DEXs leverage blockchain technology to provide enhanced security and transparency. The distributed nature of the blockchain makes it virtually impossible for hackers to compromise the entire network, reducing the risk of theft or fraud. Additionally, the open and immutable nature of blockchain records provides traders with a clear audit trail of all transactions, fostering trust and accountability.

In this topic, you find that crypto com defi wallet is very useful.

Types of Decentralized Crypto Exchanges

Decentralized crypto exchanges are platforms that facilitate the trading of cryptocurrencies without the need for a centralized intermediary. They offer various advantages over centralized exchanges, including increased security, transparency, and resistance to censorship. There are several types of decentralized crypto exchanges, each with its unique characteristics and advantages.

Order Book Exchanges

Order book exchanges are the most common type of decentralized crypto exchange. They maintain a public record of all buy and sell orders placed by traders. When a buy order matches a sell order at the same price, a trade is executed. Order book exchanges offer a high degree of transparency and allow traders to see the depth of the market and the prices at which other traders are willing to buy or sell.

Automated Market Makers (AMMs)

Automated market makers (AMMs) are a type of decentralized crypto exchange that uses smart contracts to facilitate trading. They do not maintain an order book but instead rely on liquidity pools to determine the price of cryptocurrencies. When a trader places an order, they interact with the liquidity pool, which automatically adjusts the price to maintain a balance between supply and demand.

Hybrid Exchanges

Hybrid exchanges combine the features of both order book exchanges and AMMs. They maintain an order book for some trading pairs and use AMMs for others. This allows them to offer the benefits of both types of exchanges, such as the depth of the market and the convenience of AMMs.

Benefits and Challenges of Using Decentralized Crypto Exchanges

Decentralized crypto exchanges (DEXs) offer several advantages over centralized exchanges, including increased security, reduced risk of censorship and fraud, and greater control over one's funds. However, they also come with some challenges, such as lower liquidity and trading volume, and potentially higher fees.

In this topic, you find that blockchain 101 is very useful.

Pros

One of the main benefits of using a DEX is the increased security and control over one's funds. Unlike centralized exchanges, which hold users' funds in a custodial wallet, DEXs allow users to retain custody of their private keys and manage their funds directly. This reduces the risk of theft or fraud, as users are not reliant on a third party to secure their assets.

Understand how the union of crypto mining apps for android can improve efficiency and productivity.

Another advantage of DEXs is the reduced risk of censorship and fraud. Centralized exchanges are subject to government regulation and can be forced to freeze or seize users' funds. DEXs, on the other hand, are not subject to the same level of regulation and provide users with greater privacy and autonomy.

Cons

However, DEXs also come with some challenges. One of the main drawbacks is the lower liquidity and trading volume compared to centralized exchanges. This can make it more difficult to buy or sell large amounts of cryptocurrency quickly and efficiently.

Another potential challenge is the higher fees associated with DEXs. DEXs typically charge higher fees than centralized exchanges due to the increased cost of operating a decentralized network.

Comparison of Decentralized Crypto Exchanges

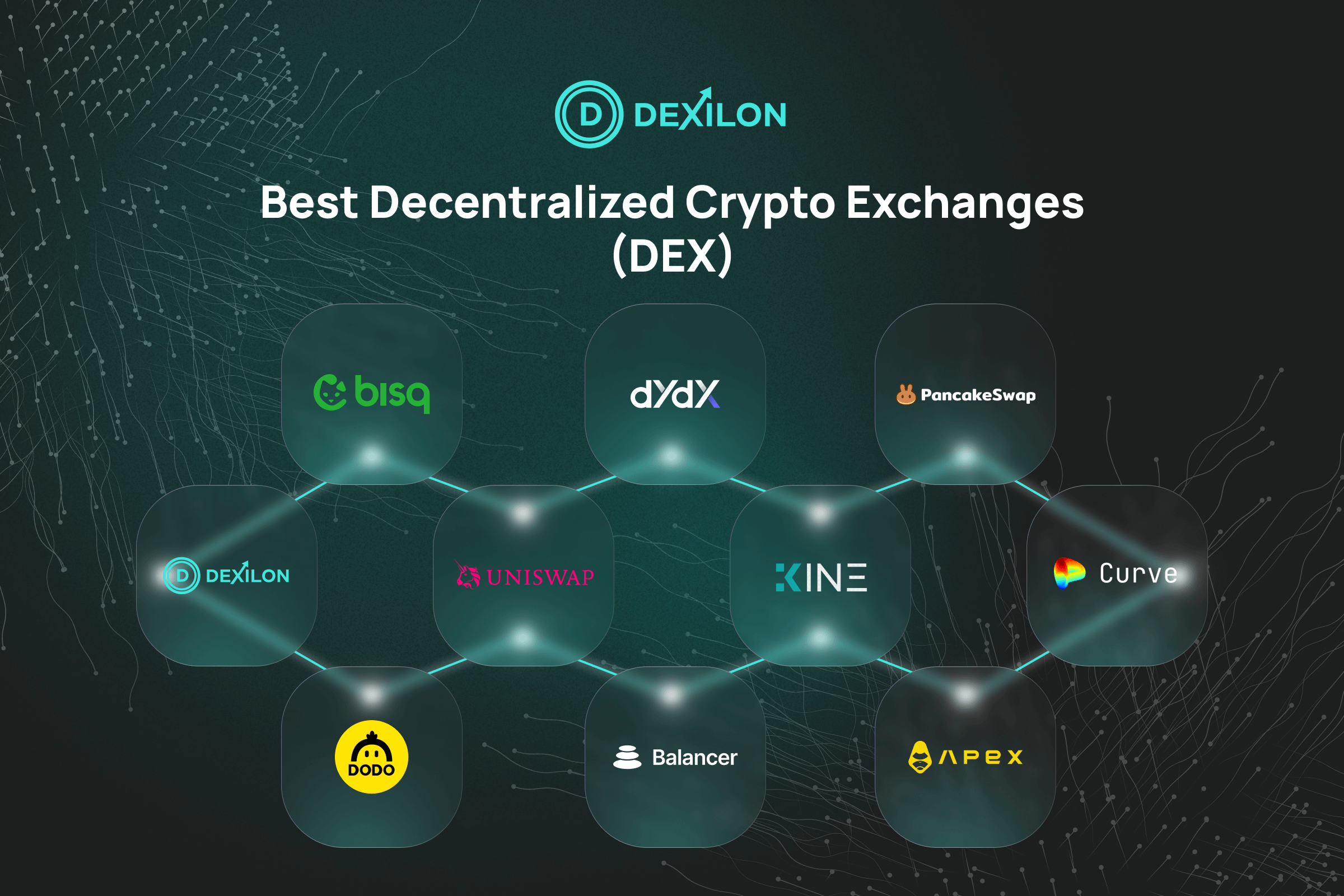

Different decentralized crypto exchanges offer unique features and advantages, catering to diverse user needs and preferences. To help you make informed decisions, we present a comparative analysis of leading decentralized exchanges based on key factors.

We evaluate these exchanges based on trading volume, fees, security features, and user experience. This comparison will provide insights into the strengths and weaknesses of each platform, enabling you to choose the exchange that best aligns with your trading requirements and priorities.

Trading Volume

Trading volume is a crucial indicator of an exchange's liquidity and popularity. Higher trading volume signifies a more active market, which can result in tighter spreads and better execution prices.

- Uniswap: One of the largest decentralized exchanges, with a daily trading volume exceeding billions of dollars.

- PancakeSwap: A prominent DEX on the Binance Smart Chain, known for its high trading volume in the decentralized finance (DeFi) space.

- SushiSwap: Another popular DEX with a significant trading volume, offering various yield farming opportunities.

Fees

Transaction fees are an important consideration when choosing a decentralized crypto exchange. Fees can vary depending on the exchange, the type of transaction, and the blockchain network used.

- Uniswap: Utilizes an automated market maker (AMM) model, where users trade directly with each other, resulting in lower transaction fees compared to traditional exchanges.

- PancakeSwap: Known for its low transaction fees, which are typically lower than those on Uniswap.

- SushiSwap: Offers a range of fee structures, including a lower fee tier for SUSHI token holders.

Security Features

Security is paramount when dealing with cryptocurrencies. Decentralized crypto exchanges employ various security measures to safeguard user funds and protect against cyber threats.

- Uniswap: Utilizes smart contracts and undergoes regular security audits to enhance the security of its platform.

- PancakeSwap: Employs a multi-signature wallet system and has implemented a bug bounty program to encourage ethical hacking and improve security.

- SushiSwap: Has a dedicated security team and collaborates with third-party security firms to ensure the integrity of its platform.

User Experience

A user-friendly interface and intuitive navigation are essential for a seamless trading experience. Decentralized crypto exchanges strive to provide accessible and user-friendly platforms.

- Uniswap: Known for its user-friendly interface, making it suitable for both experienced and novice traders.

- PancakeSwap: Offers a visually appealing and straightforward interface, catering to the needs of a diverse user base.

- SushiSwap: Provides a customizable interface, allowing users to tailor their trading experience based on their preferences.

Future of Decentralized Crypto Exchanges

The future of decentralized crypto exchanges (DEXs) looks promising, with increased adoption and mainstream acceptance expected. As the DeFi ecosystem continues to grow, DEXs will play a crucial role in providing users with a secure and transparent platform for trading crypto assets.

DEXs are expected to become more user-friendly and accessible, making them appealing to a broader range of users. The integration of DEXs with other blockchain applications, such as decentralized finance (DeFi) protocols, will create new opportunities for users to access a wide range of financial services.

Increased Adoption and Mainstream Acceptance

The increasing popularity of cryptocurrencies is expected to drive the adoption of DEXs. As more users become familiar with crypto assets, they will seek platforms that offer secure and transparent trading options. DEXs, with their decentralized nature and focus on user control, are well-positioned to meet this demand.

Integration with DeFi and Other Blockchain Applications

The integration of DEXs with DeFi protocols will create new opportunities for users to access a wide range of financial services. For example, users can use DEXs to trade crypto assets, borrow and lend funds, and participate in yield farming. This integration will make DEXs more versatile and appealing to a wider range of users.