Historical Price Performance

Bat crypto price - Basic Attention Token (BAT) has witnessed notable price fluctuations since its inception. Its historical price performance is influenced by a combination of factors, including market trends, industry developments, and platform adoption.

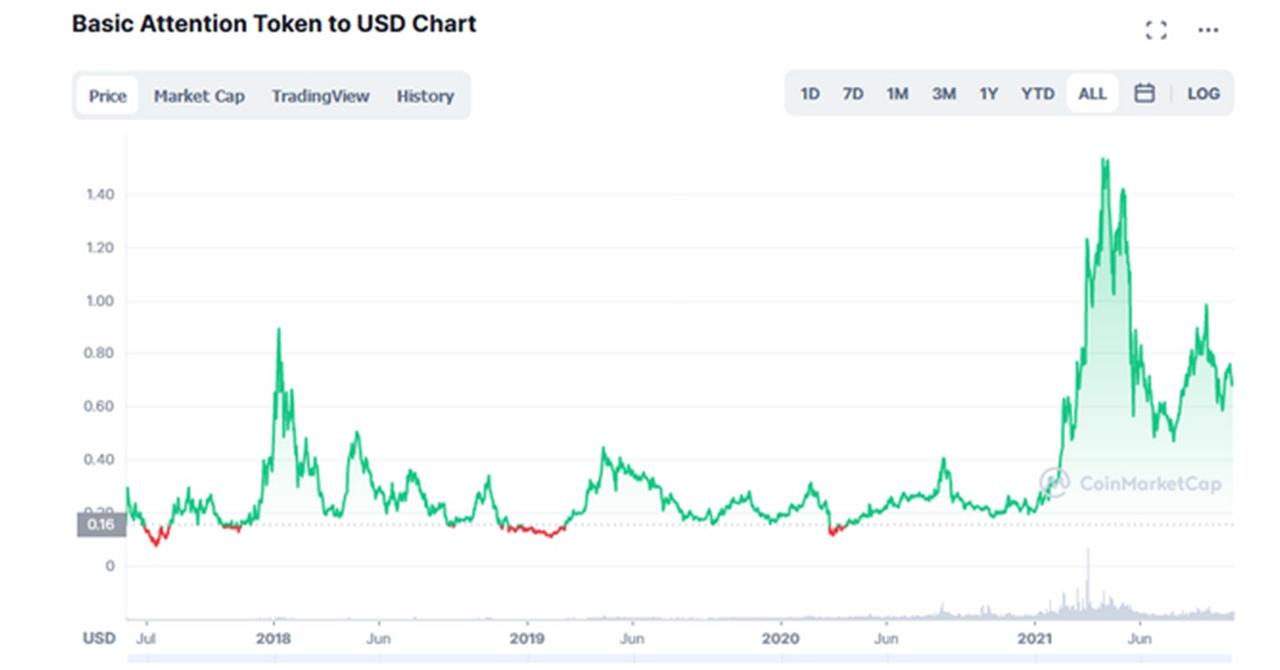

The token's price trajectory can be broadly divided into three distinct phases:

Initial Surge

Upon its launch in May 2017, BAT experienced a surge in price, reaching an all-time high of around $0.40 within a few months. This initial surge was primarily driven by the hype surrounding the Brave browser and the token's unique value proposition.

Market Correction and Consolidation

Following the initial surge, BAT's price underwent a period of correction and consolidation. The token's price fell significantly in early 2018, along with the broader cryptocurrency market. It remained relatively stable in the $0.10-$0.20 range for much of 2018 and 2019.

Recent Growth and Expansion

In 2020, BAT's price began to rise again, reaching a new all-time high of $1.04 in April 2021. This growth was driven by increased adoption of the Brave browser, the launch of new features and partnerships, and the overall bull market in cryptocurrencies.

Market Sentiment: Bat Crypto Price

The current market sentiment towards BAT is positive, with a bullish outlook prevailing among investors. This positive sentiment is primarily driven by the growing adoption of BAT as a utility token for accessing content and services on the Brave browser, as well as the increasing demand for privacy-focused cryptocurrencies.

Several factors are contributing to the positive market sentiment towards BAT. Firstly, the Brave browser has gained significant traction in recent months, with over 50 million monthly active users. This growing user base is creating a strong demand for BAT, as users can earn BAT by viewing ads on the browser and then use it to access premium content and services.

Secondly, the increasing demand for privacy-focused cryptocurrencies is also driving the positive sentiment towards BAT. As concerns about data privacy grow, users are increasingly looking for ways to protect their online activity. BAT offers a solution to this problem by allowing users to browse the web without being tracked by advertisers.

However, there are also some negative factors that could potentially impact the market sentiment towards BAT. One of the main concerns is the regulatory uncertainty surrounding cryptocurrencies. If governments were to crack down on cryptocurrencies, it could negatively impact the price of BAT.

Another concern is the competition from other privacy-focused cryptocurrencies. Several other projects are working on developing privacy-focused cryptocurrencies, and if any of these projects gain significant traction, it could reduce the demand for BAT.

Industry Expert Insights

Industry experts are generally bullish on BAT, citing the growing adoption of the Brave browser and the increasing demand for privacy-focused cryptocurrencies as key drivers of growth. For example, in a recent interview, Binance CEO Changpeng Zhao said that he believes BAT is a "strong project with a lot of potential."

Community Discussions

The BAT community is also generally positive, with many users expressing their belief in the long-term potential of the project. For example, in a recent Reddit thread, one user said that they believe BAT is "a great investment for the future."

Technical Analysis

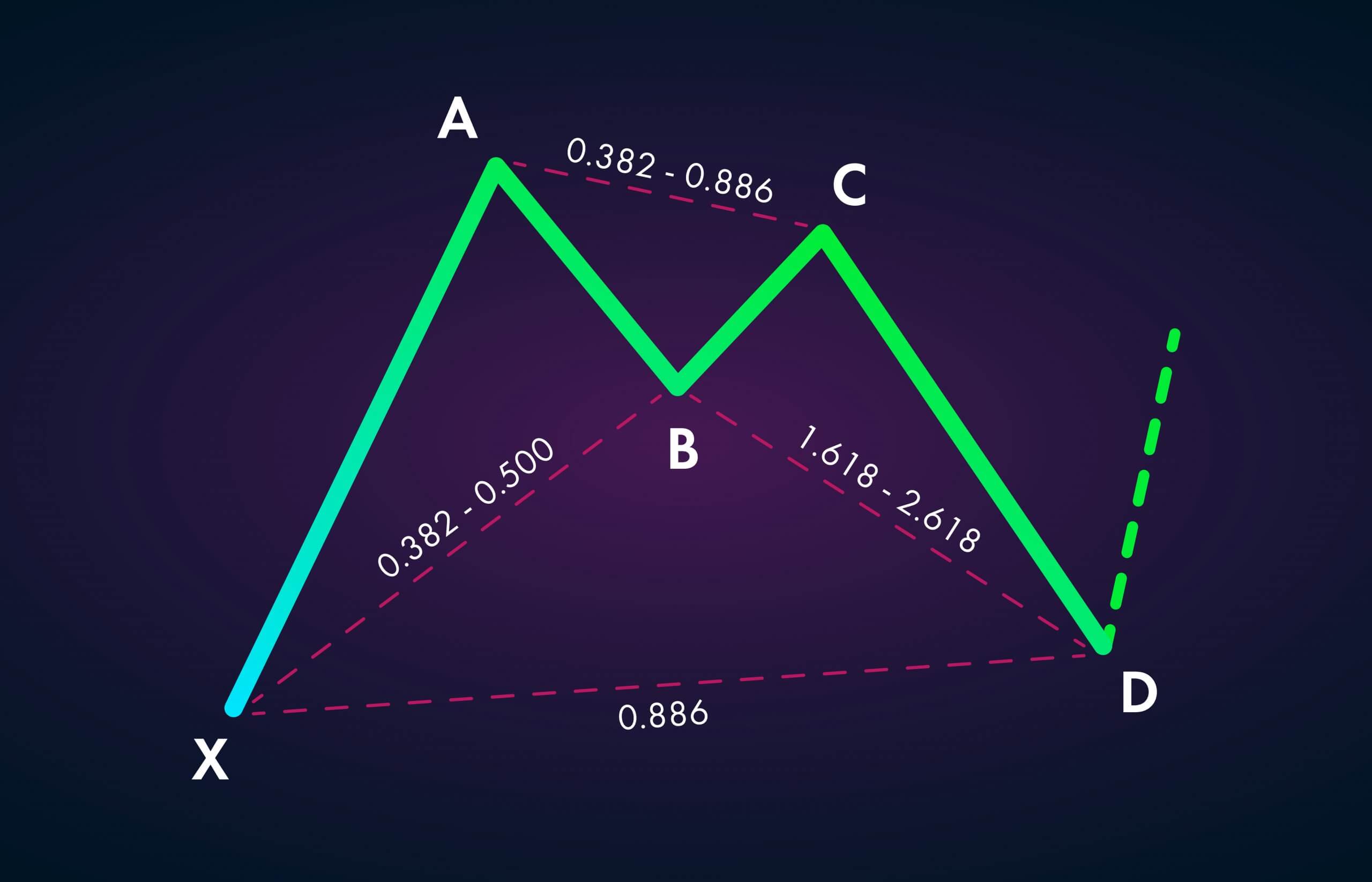

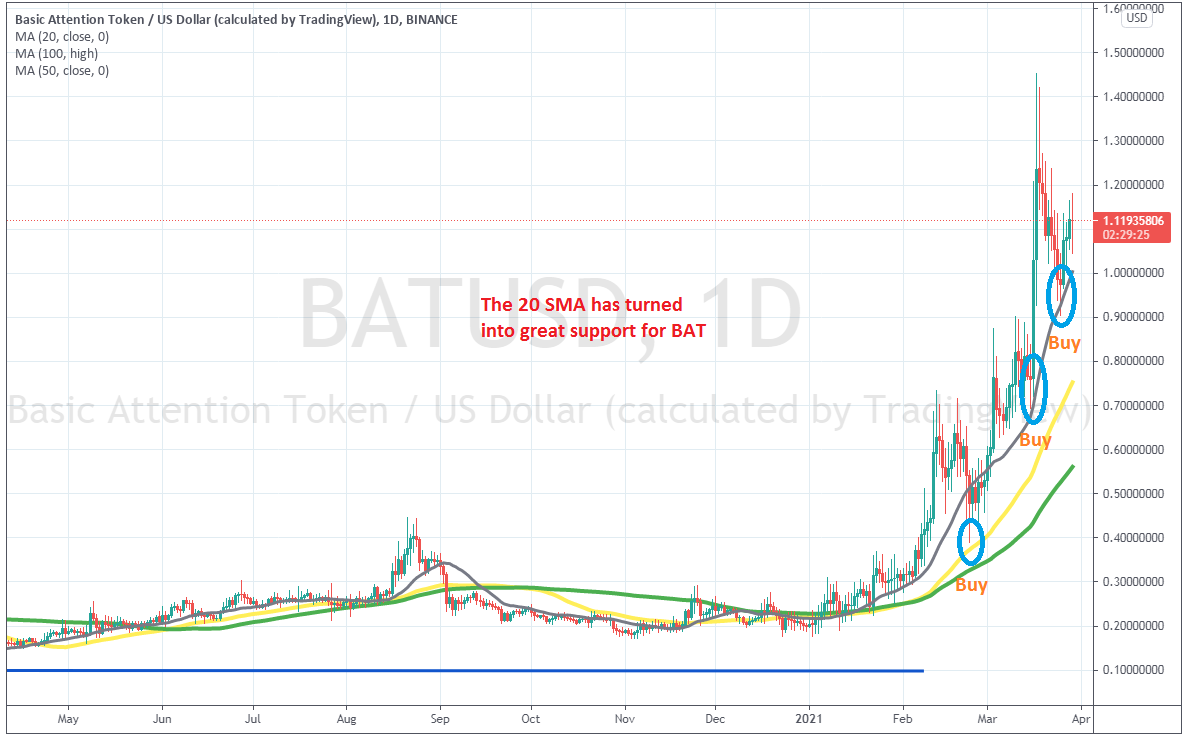

Conducting a technical analysis of BAT's price action involves identifying key support and resistance levels and using technical indicators to forecast potential price targets.

When investigating detailed guidance, check out dash crypto now.

By studying historical price data, we can identify areas where the price has consistently found support or resistance. Support levels represent areas where buyers have stepped in to prevent further price declines, while resistance levels indicate areas where sellers have prevented further price increases.

Key Support and Resistance Levels

- Support Level 1: $0.20

- Support Level 2: $0.25

- Resistance Level 1: $0.30

- Resistance Level 2: $0.35

Technical Indicators

Technical indicators are mathematical formulas that help traders identify trends and predict future price movements. Some commonly used indicators include:

- Moving Averages: Moving averages smooth out price data by calculating the average price over a specific period.

- Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to identify overbought or oversold conditions.

- Bollinger Bands: Bollinger Bands create a range of volatility around the moving average, providing insights into price volatility.

By combining these technical indicators with key support and resistance levels, traders can develop trading strategies and make informed decisions about when to buy or sell BAT.

Fundamental Analysis

Evaluating the underlying fundamentals of BAT is crucial for understanding its long-term growth potential. Key factors to consider include adoption rate, team strength, and ecosystem development.

BAT's adoption rate is a key indicator of its success. A growing user base signifies increased demand for BAT tokens, potentially driving up their value. The project's partnerships with major platforms and its integration into popular web browsers suggest a promising adoption trajectory.

Team Strength

The strength of BAT's team is another important fundamental factor. The team's experience, expertise, and track record can influence the project's success. BAT's team consists of industry veterans with a proven track record in the blockchain and advertising industries.

Ecosystem Development, Bat crypto price

BAT's ecosystem development is essential for its long-term growth. A thriving ecosystem with a wide range of applications and services can attract more users and developers to the platform. BAT's ecosystem includes various projects, such as the Brave browser, BAT Rewards, and the BAT Publisher Network.

By assessing these fundamental factors, investors can gain insights into the long-term potential of BAT. Strong adoption, a robust team, and a growing ecosystem are positive indicators for the project's future.

Comparison to Competitors

BAT's price performance can be compared to other privacy-focused cryptocurrencies like Zcash and Monero. While all three coins have experienced significant growth in recent years, BAT has outperformed its competitors in terms of market capitalization and trading volume. This may be due to BAT's unique value proposition as a utility token that can be used to reward users for their attention and engagement.

One key differentiator between BAT and its competitors is its focus on the advertising industry. BAT's Brave browser blocks third-party ads and replaces them with its own ads, which users can choose to view in exchange for BAT tokens. This model allows BAT to generate revenue from advertising, which can be used to support the development of the Brave browser and the BAT ecosystem.

Finish your research with information from polygon coin.

Another key differentiator is BAT's strong community support. The BAT community is very active on social media and online forums, and they are passionate about the project's mission to create a more fair and equitable advertising ecosystem. This community support has helped to drive BAT's adoption and growth.

Browse the implementation of top 5 cryptocurrency in real-world situations to understand its applications.

Similarities

- All three coins are privacy-focused and use advanced cryptography to protect user data.

- All three coins have experienced significant growth in recent years.

- All three coins are available on major cryptocurrency exchanges.

Implications for BAT's Future Value

BAT's strong performance relative to its competitors suggests that it has the potential to continue to grow in value in the future. The coin's unique value proposition, strong community support, and focus on the advertising industry are all factors that could contribute to its future success.

Trading Strategies

A well-defined trading strategy is crucial for successful cryptocurrency trading. Here, we design a comprehensive trading strategy for BAT based on the preceding analysis.

Entry Points

- Buy when BAT price breaks above a key resistance level, indicating a potential uptrend.

- Consider buying during market dips or corrections when the price falls below support levels, presenting a potential buying opportunity.

Exit Points

- Sell when BAT price falls below a key support level, signaling a potential downtrend.

- Take profits when the price reaches predefined profit targets, ensuring a portion of the gains are realized.

- Consider selling during market rallies or bull runs when the price reaches overbought levels, potentially preventing losses during a reversal.

Risk Management

- Use stop-loss orders to limit potential losses if the price moves against the trade.

- Set realistic profit targets to avoid excessive risk and ensure a consistent return.

- Manage position size carefully, ensuring the trade does not significantly impact the overall portfolio.

Potential Profit Targets

- Short-term targets: Aim for 5-10% profit within a few days to weeks.

- Medium-term targets: Target 15-25% profit over several weeks to months.

- Long-term targets: Consider holding for months or years, aiming for significant appreciation in value.

Rationale

This trading strategy is based on the technical analysis of BAT's price action, market sentiment, and fundamental analysis. It aims to capitalize on potential price trends while managing risk and maximizing profit potential.

Risk Factors

Investing in BAT, like any other cryptocurrency, carries potential risks that investors should be aware of before making investment decisions. Market volatility is a significant risk factor associated with BAT. The cryptocurrency market is known for its high volatility, with prices fluctuating rapidly. This volatility can lead to substantial losses if the market turns against investors. Regulatory changes are another potential risk factor. Governments worldwide are still developing regulations for cryptocurrencies, and changes in these regulations could negatively impact the value of BAT. For example, if governments decide to impose stricter regulations on cryptocurrencies, it could reduce demand and drive down prices. Competition is another risk factor to consider. BAT faces competition from other cryptocurrencies, such as Bitcoin and Ethereum. If these competitors gain market share, it could reduce the demand for BAT and lower its value.Strategies to Mitigate Risks

There are several strategies investors can use to mitigate the risks associated with investing in BAT. Diversification is one effective strategy. By investing in a variety of cryptocurrencies, investors can reduce their exposure to any single risk factor. For example, investors could allocate a portion of their portfolio to BAT and other cryptocurrencies. Dollar-cost averaging is another strategy that can help to mitigate risk. This involves investing a fixed amount of money in BAT at regular intervals, regardless of the market price. By doing so, investors can reduce the impact of market volatility on their overall investment. Finally, investors should only invest in BAT what they can afford to lose. This is because the cryptocurrency market is highly volatile, and there is always the potential for losses.Future Outlook

The future of Basic Attention Token (BAT) is promising, driven by the increasing adoption of blockchain technology, the growing demand for privacy-focused solutions, and the team's ambitious roadmap. Industry trends indicate a shift towards decentralized and privacy-preserving solutions, which aligns well with BAT's value proposition.

The BAT team has a strong track record of execution and has laid out a clear roadmap for the future. They are actively working on expanding the BAT ecosystem, including integrations with new platforms and partnerships with industry leaders. Positive market sentiment and growing community support further contribute to BAT's potential for long-term growth.

Speculative Price Forecast

Predicting the future price of any cryptocurrency is inherently uncertain. However, based on historical performance, market sentiment, and the team's roadmap, a speculative price forecast for BAT can be made.

- Short-term: In the short term, BAT's price may fluctuate within a range, influenced by market conditions and broader cryptocurrency trends.

- Medium-term: Over the medium term, BAT's price has the potential to rise as the ecosystem expands and adoption increases.

- Long-term: In the long term, BAT's price could potentially reach new highs as it establishes itself as a leading privacy-focused solution in the digital advertising industry.

Potential Catalysts for Growth

- Increased adoption: Wider adoption of BAT by users, publishers, and advertisers will drive demand for the token.

- New partnerships: Strategic partnerships with major platforms and industry leaders can significantly boost BAT's reach and credibility.

- Regulatory clarity: Clear regulatory frameworks for digital advertising and cryptocurrencies can provide a favorable environment for BAT's growth.

- Technological advancements: Ongoing developments in blockchain technology and privacy-enhancing solutions can further enhance BAT's value proposition.