Most Expensive Cryptocurrency

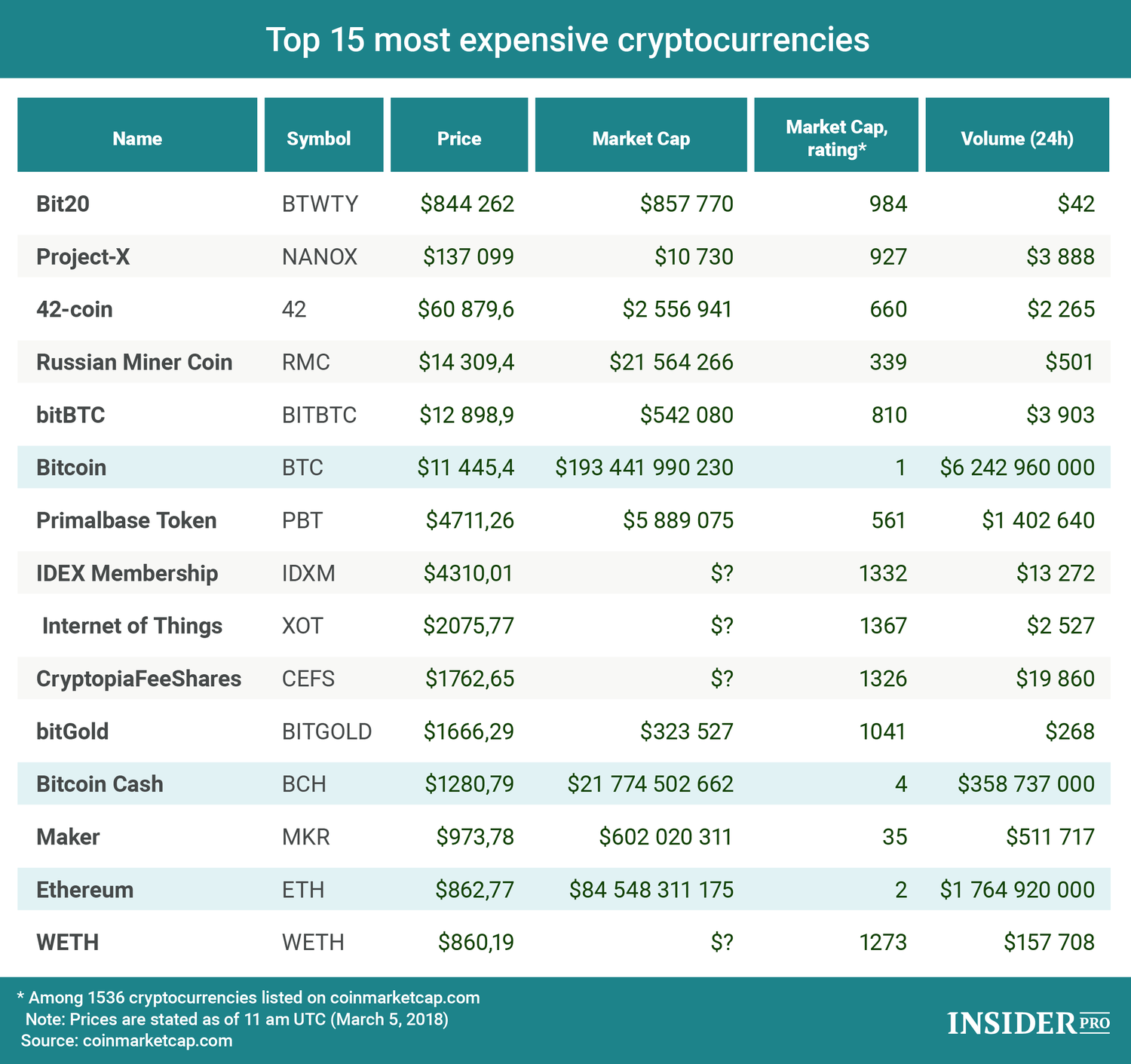

Bitcoin (BTC) is the most expensive cryptocurrency by market capitalization. As of July 2023, one Bitcoin is worth over $20,000. There are several factors that contribute to Bitcoin's high value, including its limited supply, its widespread adoption, and its strong security.Limited Supply

Bitcoin has a limited supply of 21 million coins. This means that there will never be more than 21 million Bitcoins in circulation. This scarcity is one of the main reasons why Bitcoin is so valuable.Widespread Adoption

Bitcoin is the most widely adopted cryptocurrency in the world. It is accepted by a growing number of businesses and individuals, and it is traded on major cryptocurrency exchanges. This widespread adoption has helped to increase the demand for Bitcoin, which has driven up its price.Strong Security

Bitcoin is based on blockchain technology, which is a secure and tamper-proof way to store and transmit data. This strong security makes Bitcoin a very attractive investment for those who are looking for a safe haven asset.Historical Performance

The historical price data of Bitcoin, the most expensive cryptocurrency, reveals significant fluctuations and market trends that have shaped its growth and evolution.

Since its inception in 2009, Bitcoin has experienced several major price surges and corrections, influenced by a complex interplay of factors such as technological advancements, regulatory changes, and global economic conditions.

Remember to click sushi crypto to understand more comprehensive aspects of the sushi crypto topic.

Major Price Fluctuations

- 2013 Bull Run: Bitcoin's price soared from around $100 to over $1,000, driven by increasing media attention and growing adoption.

- 2017 Bull Run: Bitcoin reached its all-time high of nearly $20,000, fueled by the influx of institutional investors and retail traders.

- 2018 Bear Market: Bitcoin's price plummeted by over 80%, wiping out significant value due to regulatory crackdowns and a decline in investor sentiment.

- 2020-2021 Bull Run: Bitcoin regained momentum, rising from around $5,000 to over $60,000, driven by increased adoption, institutional interest, and the COVID-19 pandemic.

Market Analysis

The supply and demand dynamics of a cryptocurrency play a crucial role in determining its price. Supply refers to the total number of coins in circulation, while demand represents the desire of individuals and institutions to acquire those coins.

Finish your research with information from acala crypto.

When supply exceeds demand, the price of the cryptocurrency tends to fall. This is because there are more coins available than people want to buy. Conversely, when demand exceeds supply, the price tends to rise as individuals and institutions compete to acquire the limited supply of coins.

Market Sentiment and Speculation

Market sentiment and speculation can also significantly impact the price of a cryptocurrency. Market sentiment refers to the overall attitude of investors towards a particular cryptocurrency or the cryptocurrency market as a whole. Positive market sentiment, often driven by positive news or developments, can lead to increased demand and higher prices.

Speculation, on the other hand, involves buying or selling a cryptocurrency based on the expectation that its price will rise or fall in the future. Speculation can amplify price movements, leading to rapid increases or decreases in the value of a cryptocurrency.

Obtain recommendations related to top 10 cryptocurrency 2022 that can assist you today.

Investment Considerations

Investing in the most expensive cryptocurrency offers both potential rewards and risks. The high value of the cryptocurrency indicates a strong market demand and potential for appreciation, but it also carries the risk of volatility and market fluctuations.

Investing in the most expensive cryptocurrency offers both potential rewards and risks. The high value of the cryptocurrency indicates a strong market demand and potential for appreciation, but it also carries the risk of volatility and market fluctuations. Potential Risks

* Market Volatility: The cryptocurrency market is known for its volatility, with prices fluctuating significantly over short periods. Investors should be prepared for the possibility of significant losses in value. * Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still evolving, and changes in regulations could impact the value of the cryptocurrency. * Security Risks: Cryptocurrency exchanges and wallets can be vulnerable to hacking and fraud, potentially leading to the loss of invested funds.Potential Rewards

* High Returns: The cryptocurrency has historically shown strong performance, with the potential for significant returns on investment. * Diversification: Investing in the cryptocurrency can provide diversification to an investment portfolio, reducing overall risk. * Long-Term Appreciation: Some analysts believe that the cryptocurrency has the potential for long-term appreciation, driven by increasing adoption and use.Investment Strategies and Risk Management

To mitigate risks and maximize returns, investors should consider the following strategies: * Dollar-Cost Averaging: Investing a fixed amount of money at regular intervals, regardless of price fluctuations, can reduce the impact of market volatility. * Risk Tolerance: Investors should invest only what they can afford to lose and diversify their portfolio to reduce overall risk. * Secure Storage: Use reputable cryptocurrency exchanges and wallets that implement strong security measures to protect against hacking and fraud.Technological Advancements

The most expensive cryptocurrency is underpinned by cutting-edge technology that has played a pivotal role in shaping its value and adoption.

One of the key technological advancements that has driven the value of this cryptocurrency is its underlying blockchain technology. The blockchain is a distributed ledger system that records transactions securely and transparently, providing immutability and resistance to censorship.

Consensus Mechanism

The cryptocurrency utilizes a proof-of-work consensus mechanism, which requires miners to solve complex mathematical problems to validate transactions and add new blocks to the blockchain. This mechanism ensures the security and integrity of the network, making it resistant to attacks and fraud.

Smart Contracts

Furthermore, the cryptocurrency supports smart contracts, which are self-executing programs that facilitate the creation of decentralized applications and services. Smart contracts have enabled the development of a wide range of innovative use cases, such as automated financial transactions, supply chain management, and digital identity verification.

Scalability

The cryptocurrency has also undergone significant technological advancements to improve its scalability and transaction processing speed. The implementation of layer-2 solutions, such as the Lightning Network, has enabled faster and cheaper transactions off the main blockchain, increasing the cryptocurrency's usability and adoption.

Industry Impact

Bitcoin's introduction to the cryptocurrency industry has been transformative, reshaping the landscape and pushing the boundaries of digital finance. Its decentralized nature and innovative blockchain technology have laid the groundwork for a new era of financial transactions.

Bitcoin has played a pivotal role in the growth and adoption of cryptocurrencies. Its widespread recognition and market dominance have attracted investors, developers, and businesses alike, leading to the creation of a thriving ecosystem of digital assets and blockchain-based applications.

Market Influence

Bitcoin's price fluctuations have a significant impact on the broader cryptocurrency market. As the most valuable cryptocurrency, its performance often sets the tone for other digital assets. When Bitcoin experiences a bull run, the entire market tends to follow suit, and vice versa.

This correlation highlights Bitcoin's dominance and influence within the industry. Its price movements can trigger sentiment shifts among investors, affecting the overall market sentiment and trading activity.

Technological Advancements, Most expensive cryptocurrency

Bitcoin's success has spurred innovation and technological advancements throughout the cryptocurrency industry. The development of new protocols, consensus mechanisms, and blockchain applications has been driven in part by the need to address challenges and limitations faced by Bitcoin.

As a result, the industry has witnessed the emergence of alternative cryptocurrencies (altcoins) offering unique features, such as enhanced privacy, scalability, and interoperability. These advancements have contributed to the diversification and growth of the cryptocurrency ecosystem.

Regulatory Framework

Bitcoin's growing popularity and influence have also brought about regulatory scrutiny and discussions. Governments and financial institutions are actively exploring ways to regulate cryptocurrencies, including Bitcoin, to protect investors and ensure financial stability.

The development of clear regulatory frameworks is essential for the long-term growth and adoption of cryptocurrencies. It provides a sense of legitimacy and confidence, encouraging wider participation and investment in the industry.