Overview of Most Volatile Cryptocurrencies

Cryptocurrency volatility refers to the significant price fluctuations experienced by these digital assets over short periods. The crypto market is renowned for its inherent volatility, influenced by various factors such as market sentiment, news events, and regulatory changes. Understanding the most volatile cryptocurrencies provides insights into the potential risks and rewards associated with investing in this space.

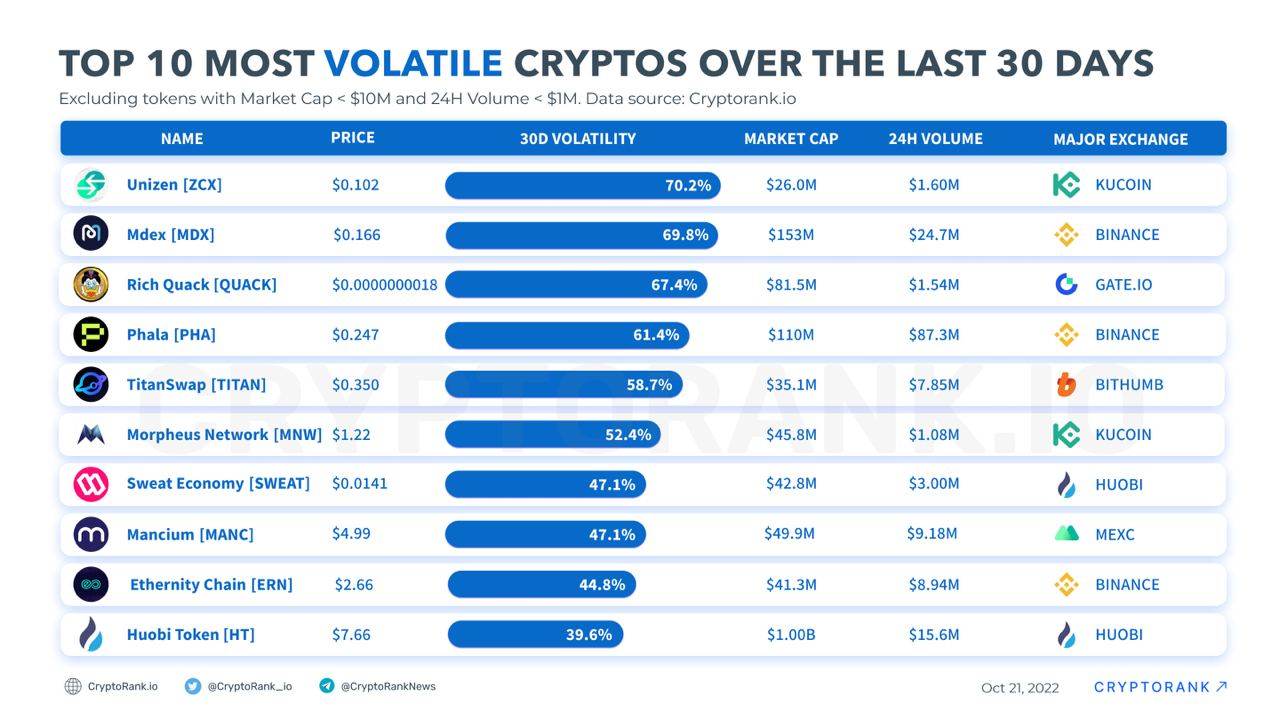

Top 10 Most Volatile Cryptocurrencies

The list of the top 10 most volatile cryptocurrencies is constantly evolving, but some of the notable ones include:

- Bitcoin (BTC)

- Ethereum (ETH)

- Binance Coin (BNB)

- Tether (USDT)

- XRP (XRP)

- Cardano (ADA)

- Solana (SOL)

- Dogecoin (DOGE)

- Shiba Inu (SHIB)

- Tron (TRX)

Factors Contributing to Volatility

Several factors contribute to the volatility of cryptocurrencies:

- Market sentiment: Positive or negative sentiment among investors can significantly impact prices.

- News events: Regulatory changes, hacks, and major announcements can trigger price swings.

- Supply and demand: Limited supply and high demand can drive up prices, while increased supply or decreased demand can lead to price declines.

- Speculation: Cryptocurrencies are often traded based on speculation, which can exacerbate price volatility.

- Technological advancements: Upgrades, forks, and new developments can impact the value of cryptocurrencies.

Historical Analysis of Cryptocurrency Volatility

The history of cryptocurrency volatility is characterized by periods of extreme price fluctuations, driven by a complex interplay of news, events, and market sentiment. This timeline explores some of the most notable periods of volatility and analyzes the underlying causes that shaped them.

Early Volatility (2009-2013)

The early years of cryptocurrency were marked by high volatility as the market was still nascent and the underlying technology was being developed. The price of Bitcoin, the first cryptocurrency, fluctuated wildly, often rising and falling by double-digit percentages in a single day.

Mt. Gox Hack (2014)

In 2014, the Mt. Gox exchange, which at the time handled over 70% of Bitcoin transactions, was hacked, resulting in the theft of 850,000 bitcoins. This event caused a sharp decline in the price of Bitcoin and led to increased scrutiny of cryptocurrency exchanges.

2017 Bull Run

In 2017, the cryptocurrency market experienced a significant bull run, with the price of Bitcoin rising from around $1,000 to over $20,000. This surge was driven by a combination of factors, including increased institutional interest, positive news coverage, and speculation.

2018 Bear Market

The 2017 bull run was followed by a prolonged bear market in 2018, during which the price of Bitcoin fell by over 80%. This decline was attributed to a combination of factors, including regulatory concerns, negative news coverage, and a decline in investor sentiment.

Investigate the pros of accepting nkn crypto in your business strategies.

2020-2021 Bull Run

The cryptocurrency market experienced another bull run in 2020-2021, driven by factors such as the COVID-19 pandemic, increased institutional adoption, and the rise of decentralized finance (DeFi). The price of Bitcoin reached a new all-time high of over $64,000 in April 2021.

Impact of News, Events, and Market Sentiment

News, events, and market sentiment have a significant impact on cryptocurrency volatility. Positive news coverage, regulatory developments, and major hacks can all lead to increased volatility and price fluctuations. Similarly, negative news, market downturns, and investor fear can lead to decreased volatility and price declines.

Methods for Measuring Cryptocurrency Volatility

Cryptocurrency volatility, a measure of price fluctuations, is a crucial aspect for investors and traders. Several statistical measures quantify this volatility, providing insights into market dynamics and risk assessment.

One common measure is Standard Deviation, which calculates the spread of prices around the mean. A higher standard deviation indicates greater volatility.

Standard Deviation = √(Σ(xi - μ)² / N)where xi is the price at time i, μ is the mean price, and N is the number of observations.

Find out further about the benefits of opera wallet that can provide significant benefits.

Historical Volatility

Historical volatility measures price fluctuations over a specific period, typically using daily closing prices. It provides a retrospective view of market behavior.

Historical Volatility = Standard Deviation of daily closing prices over a period

Implied Volatility

Implied volatility, derived from options pricing models, estimates future volatility based on market expectations. It reflects the market's sentiment and provides insights into potential price movements.

Implied Volatility = Volatility implied by options pricing models

Beta, Most volatile crypto

Beta measures the volatility of a cryptocurrency relative to a benchmark, such as Bitcoin or the S&P 500. A beta greater than 1 indicates higher volatility than the benchmark, while a beta less than 1 indicates lower volatility.

Strategies for Managing Cryptocurrency Volatility

Cryptocurrency volatility presents unique challenges for investors, but various strategies can help mitigate risk and enhance returns.

One common approach is hedging, which involves using financial instruments like futures or options to offset potential losses. For example, an investor holding Bitcoin could purchase a Bitcoin futures contract that locks in a future price, protecting against a sudden drop in value.

Browse the multiple elements of hnt token to gain a more broad understanding.

Diversification Strategies

Diversification is another effective strategy, where investors allocate funds across different cryptocurrencies or asset classes to reduce overall risk. By investing in assets with low correlation, investors can minimize the impact of volatility in any single asset.

Risk Management Tools

Risk management tools like stop-loss orders and position sizing help investors manage risk. Stop-loss orders automatically sell an asset if it falls below a predetermined price, limiting potential losses. Position sizing ensures that investments are proportional to an investor's risk tolerance and financial situation.

These strategies, while effective, have potential drawbacks. Hedging can be expensive and complex, while diversification may limit potential returns. Risk management tools require careful monitoring and may not always prevent losses.

Impact of Cryptocurrency Volatility on the Market

Cryptocurrency volatility has a significant impact on the broader financial market, creating both risks and opportunities for investors.

One of the primary risks is the potential for contagion effects. When the value of a major cryptocurrency experiences a sharp decline, it can trigger sell-offs in other cryptocurrencies and even traditional assets.

Institutional Investors

Institutional investors, such as hedge funds and pension funds, are increasingly allocating a portion of their portfolios to cryptocurrencies. However, the volatility of these assets can make it challenging for institutions to manage their risk exposure.

Retail Traders

Retail traders, who typically have less capital and experience than institutional investors, are particularly vulnerable to the risks of cryptocurrency volatility. They may be tempted to trade on margin or leverage, which can amplify their losses in a downturn.

Future Outlook for Cryptocurrency Volatility: Most Volatile Crypto

The future of cryptocurrency volatility is uncertain, but there are several potential trends that could influence its trajectory.

One factor that could contribute to increased volatility is the growing adoption of cryptocurrencies by institutional investors. As more large investors enter the market, they may bring with them greater demand for cryptocurrencies, which could lead to price fluctuations.

Regulation

Regulation could also play a role in shaping the future of cryptocurrency volatility. If governments impose stricter regulations on cryptocurrencies, it could lead to increased volatility as investors become more uncertain about the future of the market.

Technological Advancements

Technological advancements could also have a significant impact on cryptocurrency volatility. The development of new technologies, such as blockchain scaling solutions, could make cryptocurrencies more efficient and scalable, which could lead to reduced volatility.

Market Adoption

The level of market adoption could also influence cryptocurrency volatility. If cryptocurrencies become more widely adopted, it could lead to reduced volatility as the market becomes more mature and stable.

Overall, the future of cryptocurrency volatility is uncertain, but there are several factors that could influence its trajectory. It is important for investors to be aware of these factors and to consider them when making investment decisions.