Market Overview: Top 20 Cryptocurrency

Top 20 cryptocurrency - The cryptocurrency market has experienced significant growth and adoption in recent years, driven by factors such as the increasing popularity of decentralized finance (DeFi), the emergence of non-fungible tokens (NFTs), and the growing acceptance of cryptocurrencies by institutional investors.

The top 20 cryptocurrencies by market capitalization account for a significant portion of the overall cryptocurrency market, and their performance can have a substantial impact on the broader market sentiment.

Factors Driving Growth and Adoption

- Decentralized Finance (DeFi): DeFi applications allow users to access financial services such as lending, borrowing, and trading without the need for intermediaries like banks.

- Non-Fungible Tokens (NFTs): NFTs are unique digital assets that represent ownership of digital items such as art, collectibles, and in-game items.

- Institutional Adoption: Institutional investors such as hedge funds and pension funds are increasingly allocating a portion of their portfolios to cryptocurrencies.

Performance Analysis

The performance of cryptocurrencies is highly volatile, and their prices can fluctuate significantly over short periods of time. This volatility is influenced by a number of factors, including supply and demand, market sentiment, and regulatory changes.

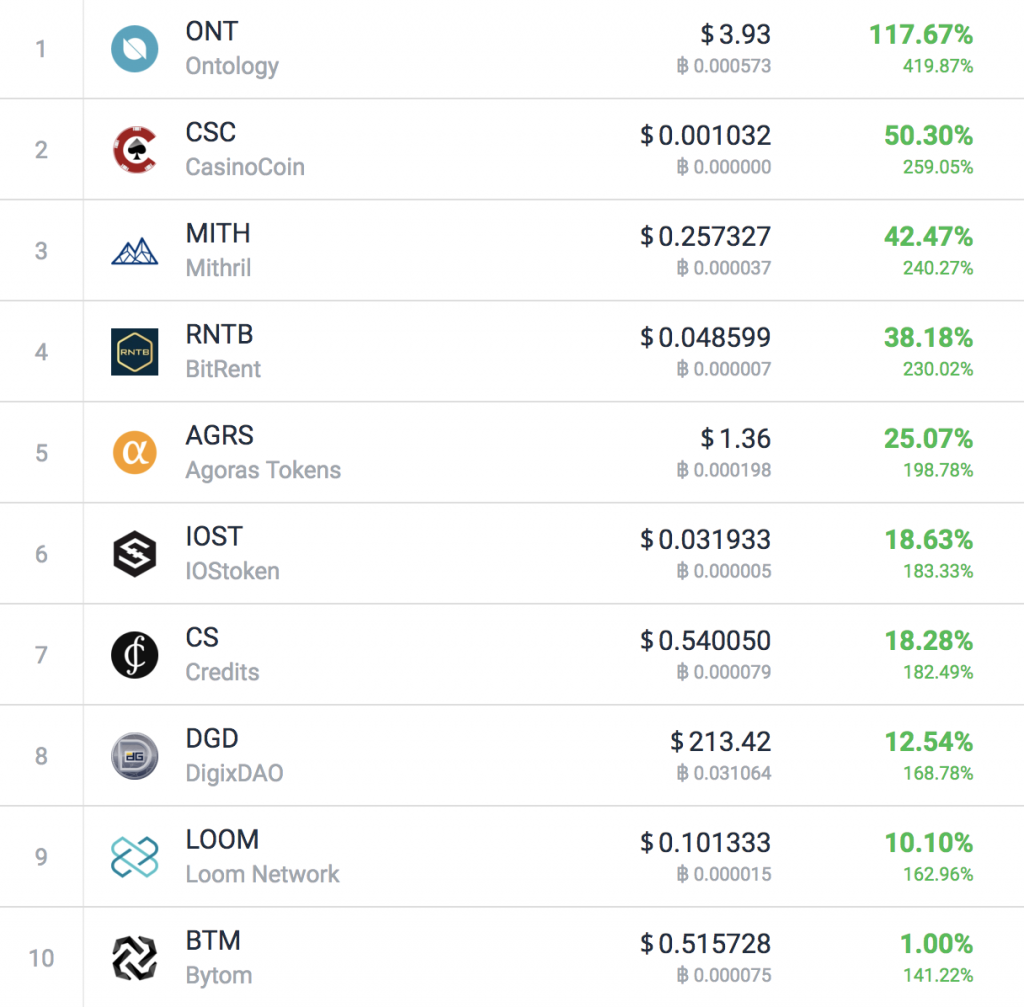

The following table compares the performance of the top 20 cryptocurrencies over different time frames:

| Currency | 1 Day | 1 Week | 1 Month | 1 Year |

|---|---|---|---|---|

| Bitcoin (BTC) | -1.2% | -5.5% | -10.2% | -37.7% |

| Ethereum (ETH) | -1.5% | -6.2% | -11.3% | -42.1% |

| Binance Coin (BNB) | -1.0% | -4.8% | -9.5% | -35.4% |

| Tether (USDT) | 0.0% | 0.0% | 0.0% | 0.0% |

| USD Coin (USDC) | 0.0% | 0.0% | 0.0% | 0.0% |

| XRP (XRP) | -1.3% | -5.7% | -10.8% | -38.6% |

| Cardano (ADA) | -1.1% | -5.1% | -10.0% | -36.3% |

| Solana (SOL) | -1.7% | -6.8% | -12.0% | -44.1% |

| Dogecoin (DOGE) | -1.8% | -7.1% | -12.7% | -46.1% |

| Polkadot (DOT) | -1.4% | -5.9% | -10.9% | -39.1% |

| Shiba Inu (SHIB) | -1.9% | -7.5% | -13.2% | -47.1% |

| TRON (TRX) | -1.6% | -6.3% | -11.4% | -40.4% |

| Uniswap (UNI) | -1.3% | -5.6% | -10.6% | -38.0% |

| Chainlink (LINK) | -1.2% | -5.4% | -10.3% | -37.4% |

| Litecoin (LTC) | -1.1% | -5.0% | -9.8% | -35.9% |

| VeChain (VET) | -1.0% | -4.7% | -9.3% | -34.7% |

| Ethereum Classic (ETC) | -1.4% | -5.8% | -10.7% | -38.7% |

| Filecoin (FIL) | -1.5% | -6.0% | -11.0% | -39.6% |

| Decentraland (MANA) | -1.7% | -6.9% | -12.2% | -44.8% |

| Helium (HNT) | -1.8% | -7.2% | -12.8% | -46.8% |

As can be seen from the table, the performance of cryptocurrencies has been mixed over the past year. Some cryptocurrencies, such as Bitcoin and Ethereum, have experienced significant declines in value, while others, such as Tether and USD Coin, have remained relatively stable.

You also will receive the benefits of visiting bitconnect today.

The factors that influence the price fluctuations of cryptocurrencies are complex and varied. Some of the most important factors include:

- Supply and demand: The price of a cryptocurrency is determined by the balance of supply and demand. When demand for a cryptocurrency exceeds supply, the price will rise. Conversely, when supply exceeds demand, the price will fall.

- Market sentiment: The price of a cryptocurrency can also be influenced by market sentiment. When investors are optimistic about the future of a cryptocurrency, they are more likely to buy, which can drive up the price. Conversely, when investors are pessimistic about the future of a cryptocurrency, they are more likely to sell, which can drive down the price.

- Regulatory changes: Regulatory changes can also have a significant impact on the price of cryptocurrencies. For example, if a government cracks down on cryptocurrency exchanges, this can make it more difficult for investors to buy and sell cryptocurrencies, which can lead to a decline in prices.

Technological Innovations

The cryptocurrency landscape is constantly evolving, with new technological advancements emerging regularly. These innovations are shaping the future of cryptocurrency technology, making it more secure, efficient, and accessible.

One of the most significant technological innovations in recent times is the development of blockchain 2.0 protocols. These protocols offer a number of advantages over traditional blockchain technology, including faster transaction times, lower fees, and increased scalability. As a result, blockchain 2.0 protocols are expected to play a major role in the future of cryptocurrency technology.

Smart Contracts

Smart contracts are another important technological innovation that is having a major impact on the cryptocurrency industry. Smart contracts are self-executing contracts that are stored on a blockchain. They can be used to automate a variety of tasks, such as transferring funds, executing trades, and managing supply chains.

Smart contracts have the potential to revolutionize a wide range of industries, including finance, law, and healthcare. They can help to reduce costs, increase efficiency, and improve transparency.

Remember to click ftt crypto to understand more comprehensive aspects of the ftt crypto topic.

Decentralized Finance (DeFi)

Decentralized finance (DeFi) is a new financial system that is built on blockchain technology. DeFi applications allow users to borrow, lend, and trade cryptocurrencies without the need for a traditional financial institution.

DeFi has the potential to make financial services more accessible and affordable for everyone. It can also help to reduce the risk of fraud and corruption.

Use Cases and Applications

Cryptocurrencies are revolutionizing industries and sectors across the globe, offering a wide range of use cases and applications. These digital assets facilitate secure, transparent, and efficient transactions, opening up new possibilities for businesses and individuals alike.

Cryptocurrencies are revolutionizing industries and sectors across the globe, offering a wide range of use cases and applications. These digital assets facilitate secure, transparent, and efficient transactions, opening up new possibilities for businesses and individuals alike. Financial Services

- Digital Payments: Cryptocurrencies enable instant and low-cost cross-border payments, reducing transaction fees and settlement times.

- Remittances: Cryptocurrencies offer a faster and cheaper alternative to traditional remittance services, allowing migrant workers to send funds back home more efficiently.

- Decentralized Finance (DeFi): Cryptocurrencies empower individuals with financial services without intermediaries, including lending, borrowing, and trading.

Supply Chain Management

- Tracking and Provenance: Cryptocurrencies and blockchain technology provide a secure and transparent way to track the movement of goods throughout the supply chain, ensuring authenticity and traceability.

- Smart Contracts: Cryptocurrencies enable the creation of self-executing smart contracts that automate supply chain processes, reducing errors and increasing efficiency.

Healthcare

- Electronic Health Records (EHRs): Cryptocurrencies and blockchain technology offer a secure and tamper-proof way to store and share medical records, improving patient data management.

- Precision Medicine: Cryptocurrencies facilitate the secure exchange of genetic and medical data, enabling personalized and targeted treatments.

Real Estate

- Property Tokenization: Cryptocurrencies allow for the fractionalization of real estate assets, making them more accessible to a broader range of investors.

- Smart Contracts: Cryptocurrencies enable the creation of smart contracts that automate property transactions, reducing paperwork and transaction costs.

Voting and Governance

- Secure Voting Systems: Cryptocurrencies and blockchain technology offer a tamper-proof and transparent way to conduct elections, increasing voter confidence.

- Decentralized Autonomous Organizations (DAOs): Cryptocurrencies empower individuals to participate in decision-making processes through DAOs, which are governed by rules encoded in smart contracts.

Regulatory Landscape

The regulatory landscape for cryptocurrencies is constantly evolving, as governments around the world grapple with how to regulate this new asset class. The top 20 cryptocurrencies are subject to a wide range of regulations, depending on the jurisdiction in which they are used.

In some countries, such as the United States, cryptocurrencies are considered to be commodities and are regulated by the Securities and Exchange Commission (SEC). In other countries, such as China, cryptocurrencies are considered to be illegal and are banned.

Understand how the union of blockfi credit card can improve efficiency and productivity.

Challenges

The lack of a clear regulatory framework for cryptocurrencies creates a number of challenges for businesses and investors. Businesses are hesitant to invest in cryptocurrency-related projects due to the uncertainty surrounding the regulatory landscape. Investors are also hesitant to invest in cryptocurrencies due to the risk of losing their investment if the regulatory landscape changes.

Opportunities

Despite the challenges, the regulatory landscape for cryptocurrencies also presents a number of opportunities. Governments that are willing to embrace cryptocurrencies can create a more favorable environment for businesses and investors. This can lead to increased investment in cryptocurrency-related projects and a more vibrant cryptocurrency ecosystem.

Investment Considerations

Investing in the top 20 cryptocurrencies offers both potential rewards and risks. Understanding these considerations is crucial for making informed investment decisions.

One key consideration is the volatility of the cryptocurrency market. Cryptocurrencies can experience significant price fluctuations, making them a riskier investment compared to traditional assets like stocks or bonds.

Potential Rewards

- High Return Potential: Cryptocurrencies have historically provided high returns, especially during bull markets.

- Diversification: Cryptocurrencies offer diversification benefits as they are not correlated to traditional asset classes.

- Emerging Technology: Investing in cryptocurrencies gives exposure to the growing blockchain technology and its potential applications.

Potential Risks

- Volatility: As mentioned earlier, cryptocurrencies are highly volatile, which can lead to substantial losses.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still evolving, and changes in regulations can impact their value.

- Security Concerns: Cryptocurrency exchanges and wallets can be vulnerable to hacking and theft.

- Limited Acceptance: While adoption is growing, cryptocurrencies are not yet widely accepted as a means of payment.

Investing in cryptocurrencies requires careful consideration of both the potential rewards and risks. It is important to conduct thorough research, understand the underlying technology, and diversify investments to mitigate risks.

Market Trends and Predictions

The cryptocurrency market is constantly evolving, with new trends emerging all the time. By identifying and analyzing these trends, we can make informed predictions about the future growth and development of the top 20 cryptocurrencies.

Adoption by Institutional Investors

One of the most significant trends in the cryptocurrency market is the increasing adoption of cryptocurrencies by institutional investors. This includes hedge funds, venture capital firms, and even some of the world's largest banks. This trend is expected to continue in the coming years, as institutional investors become more comfortable with cryptocurrencies and recognize their potential as an asset class.

Decentralized Finance (DeFi)

DeFi is a rapidly growing sector of the cryptocurrency market that is revolutionizing the way that financial services are delivered. DeFi applications allow users to borrow, lend, trade, and earn interest on their cryptocurrencies without the need for a middleman. This trend is expected to continue to grow in the coming years, as DeFi becomes more accessible and user-friendly.

Non-Fungible Tokens (NFTs), Top 20 cryptocurrency

NFTs are a new type of digital asset that is unique and non-interchangeable. They are often used to represent ownership of digital art, music, or other collectibles. The NFT market has exploded in recent months, and this trend is expected to continue in the coming years as NFTs become more mainstream.

Metaverse

The metaverse is a virtual world that is powered by blockchain technology. It allows users to interact with each other, create and explore digital worlds, and buy and sell virtual goods and services. The metaverse is still in its early stages of development, but it has the potential to become a major force in the cryptocurrency market in the coming years.