Shiba Inu Crypto Price Overview

Shiba inu crypto price - Shiba Inu, a decentralized cryptocurrency, has witnessed a remarkable journey since its inception in August 2020. Its price has experienced significant fluctuations, driven by a combination of market trends, community sentiment, and broader economic factors.

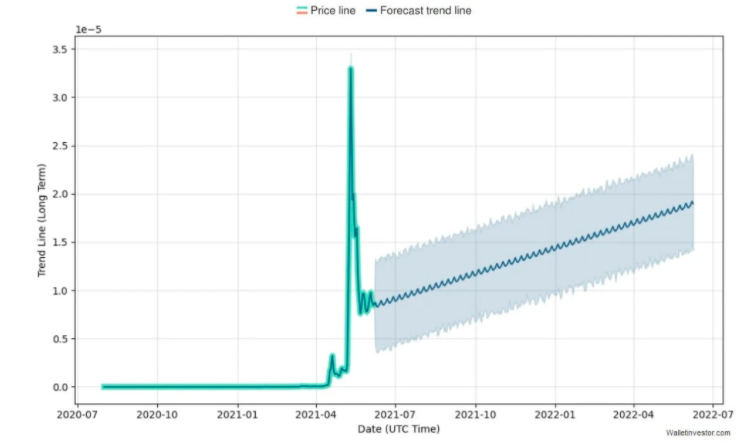

Shiba Inu's price has exhibited periods of rapid appreciation, followed by corrections and consolidations. In October 2021, it reached an all-time high of $0.000088, fueled by a surge in retail investor interest and the overall bullish sentiment in the cryptocurrency market.

You also will receive the benefits of visiting pi network coin today.

Key Factors Influencing Price

- Market Trends: Shiba Inu's price is influenced by the broader trends in the cryptocurrency market, particularly the performance of Bitcoin and Ethereum.

- Community Sentiment: The Shiba Inu community plays a significant role in shaping its price. Positive sentiment and hype can drive demand, while negative sentiment can lead to sell-offs.

- News and Events: Major news or events related to Shiba Inu, such as exchange listings, partnerships, or developments within the ecosystem, can impact its price.

- Economic Conditions: The overall economic climate, including interest rates, inflation, and global events, can influence the demand for cryptocurrencies, including Shiba Inu.

Key Metrics and Statistics, Shiba inu crypto price

- Current Price: $0.000013 (as of February 23, 2023)

- All-Time High: $0.000088 (October 2021)

- Circulating Supply: 549 trillion

- Market Cap: $7.2 billion

- Trading Volume: $1.2 billion (24-hour average)

Market Analysis and Trends

Shiba Inu's market sentiment and outlook are primarily driven by its underlying fundamentals, community support, and market trends. Technical indicators, news, events, and regulatory changes also play a significant role in shaping its price movements.

Shiba Inu's price has been influenced by its community's strong belief in its potential as a meme coin and a viable investment. The coin's popularity has attracted a large and active community, which has contributed to its market liquidity and price stability.

Technical Indicators and Patterns

Technical analysis provides insights into potential future price movements by studying historical price data and identifying patterns and trends. Key technical indicators for Shiba Inu include moving averages, support and resistance levels, and momentum indicators.

- Moving Averages: Moving averages smooth out price fluctuations and indicate the overall trend. Shiba Inu's 50-day and 200-day moving averages are widely followed by traders to identify long-term trends.

- Support and Resistance Levels: These levels represent areas where the price has historically found support or resistance. Identifying these levels can help traders determine potential reversal points and areas of consolidation.

- Momentum Indicators: Indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) measure the strength and momentum of price movements. These indicators can provide insights into potential trend reversals and overbought/oversold conditions.

News, Events, and Regulatory Changes

News, events, and regulatory changes can significantly impact Shiba Inu's price. Positive news, such as partnerships, listings on major exchanges, or community initiatives, can boost investor sentiment and drive up the price.

Conversely, negative news, regulatory concerns, or market downturns can trigger sell-offs and lead to price declines. It is essential for investors to stay informed about the latest developments surrounding Shiba Inu and the cryptocurrency market in general.

For descriptions on additional topics like crypto shiba inu, please visit the available crypto shiba inu.

Comparison with Other Cryptocurrencies

Shiba Inu's price performance has been compared to other similar cryptocurrencies, such as Dogecoin and Floki Inu. While these cryptocurrencies share some similarities, such as their meme-based origins and large online communities, they also exhibit key differences in their price dynamics.

Check polygon crypto to inspect complete evaluations and testimonials from users.

Key Differences

- Market Capitalization: Shiba Inu has a significantly higher market capitalization than Dogecoin and Floki Inu, which gives it more stability and liquidity.

- Trading Volume: Shiba Inu has a much higher trading volume than Dogecoin and Floki Inu, indicating greater market activity and interest.

- Price Volatility: Shiba Inu has experienced higher price volatility than Dogecoin, but lower volatility than Floki Inu. This suggests that Shiba Inu's price is more influenced by market sentiment and speculation.

Factors Contributing to Shiba Inu's Unique Price Characteristics

Several factors may contribute to Shiba Inu's unique price characteristics:- Community Support: Shiba Inu has a large and active online community, which has played a significant role in driving its popularity and price.

- Media Attention: Shiba Inu has received significant media attention, which has helped to increase its visibility and attract new investors.

- Speculation: Shiba Inu's meme-based origins and low price have made it attractive to speculators, who may drive its price higher in the short term.

Technical Analysis

Shiba Inu's price chart exhibits both bullish and bearish trends, with several key technical indicators providing insights into potential trading opportunities and risk management strategies.

Support and resistance levels, moving averages, and other indicators can assist traders in identifying areas of potential price reversals and trend continuations.

Support and Resistance Levels

Support levels represent areas where buyers are likely to step in and prevent further price declines, while resistance levels indicate areas where sellers may take profits or enter short positions.

Identifying these levels can help traders determine potential entry and exit points for trades.

Moving Averages

Moving averages smooth out price fluctuations and provide a general trend direction.

Traders can use different moving averages, such as the 50-day or 200-day moving average, to identify potential support and resistance levels and confirm trend strength.

Other Technical Indicators

Additional technical indicators, such as the Relative Strength Index (RSI) and Bollinger Bands, can provide insights into market momentum and volatility.

Traders can use these indicators to identify overbought or oversold conditions and potential trend reversals.

Future Price Predictions: Shiba Inu Crypto Price

Predicting the future price of any cryptocurrency, including Shiba Inu, involves various models and forecasts. These predictions often consider factors like historical price data, market sentiment, technical analysis, and the overall cryptocurrency landscape.

Predicting the future price of any cryptocurrency, including Shiba Inu, involves various models and forecasts. These predictions often consider factors like historical price data, market sentiment, technical analysis, and the overall cryptocurrency landscape. Assumptions and Limitations

It's important to note that price predictions are not exact and should be taken with caution. Assumptions and limitations of these predictions include:- Historical data: Predictions rely on past performance, which may not always indicate future results.

- Market sentiment: Predictions can be influenced by subjective factors like hype or fear, which can lead to volatility.

- Technical analysis: While technical indicators can provide insights, they are not always reliable predictors of future price movements.

Potential Price Scenarios

Despite the uncertainties, some potential price scenarios for Shiba Inu have been suggested:- Bullish scenario: If the market sentiment remains positive and adoption increases, Shiba Inu could potentially reach new highs in the future.

- Bearish scenario: If the market experiences a downturn or if Shiba Inu fails to gain widespread adoption, its price could decline.

- Stable scenario: Shiba Inu's price could stabilize within a certain range, fluctuating based on market conditions.