Coinbase Trading Platform

Coinbase trading - Coinbase is a secure and user-friendly cryptocurrency exchange that allows users to buy, sell, and trade digital assets. It offers a wide range of features, including a simple and intuitive interface, competitive fees, and a high level of security.

Learn about more about the process of best cryptocurrency to invest today in the field.

Key Features

- Easy-to-use interface: Coinbase's user interface is designed to be simple and easy to navigate, making it accessible to both beginners and experienced traders.

- Wide range of cryptocurrencies: Coinbase supports a wide range of cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and many others.

- Competitive fees: Coinbase's fees are competitive with other cryptocurrency exchanges, and they offer a variety of fee structures to meet the needs of different traders.

- High level of security: Coinbase employs a variety of security measures to protect its users' funds, including two-factor authentication, cold storage, and insurance.

How to Use Coinbase

- Create an account: To create a Coinbase account, you will need to provide your name, email address, and a password.

- Verify your identity: Coinbase requires all users to verify their identity before they can start trading. This involves providing a government-issued ID and a proof of address.

- Fund your account: You can fund your Coinbase account using a variety of methods, including bank transfer, credit card, or debit card.

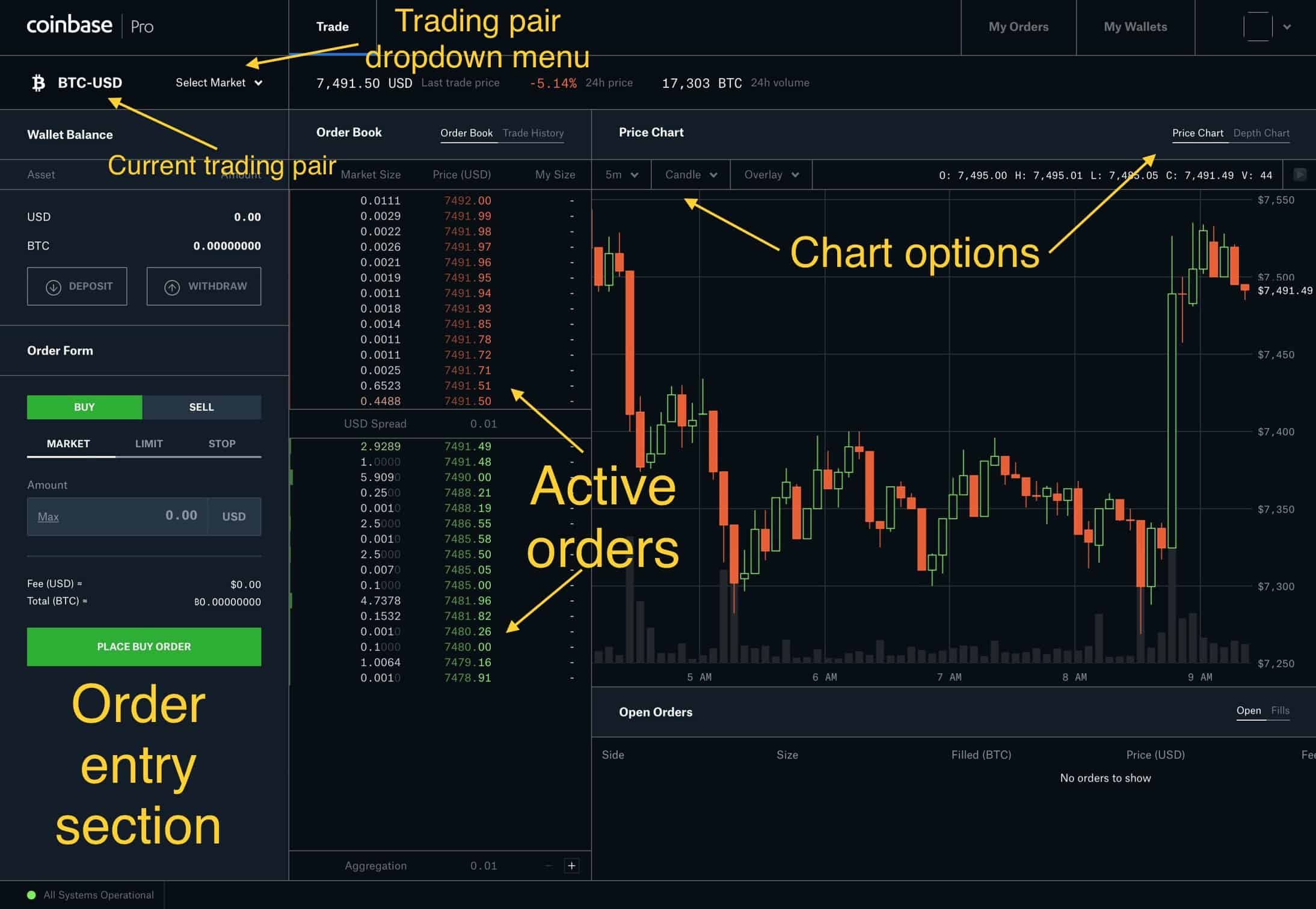

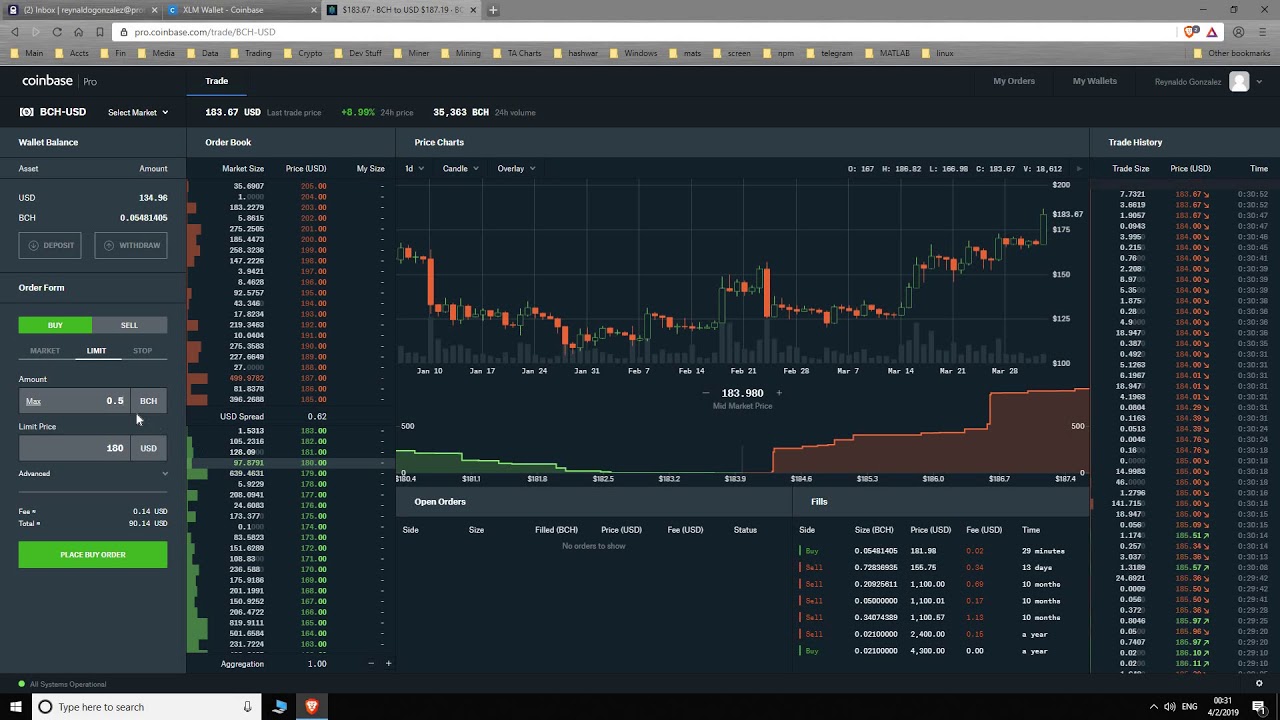

- Start trading: Once your account is funded, you can start trading cryptocurrencies. Coinbase offers a variety of order types, including market orders, limit orders, and stop orders.

Advantages of Using Coinbase

- Easy to use: Coinbase's user interface is designed to be simple and easy to navigate, making it accessible to both beginners and experienced traders.

- Wide range of cryptocurrencies: Coinbase supports a wide range of cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and many others.

- Competitive fees: Coinbase's fees are competitive with other cryptocurrency exchanges, and they offer a variety of fee structures to meet the needs of different traders.

- High level of security: Coinbase employs a variety of security measures to protect its users' funds, including two-factor authentication, cold storage, and insurance.

Disadvantages of Using Coinbase

- Limited trading options: Coinbase offers a limited number of trading options compared to some other cryptocurrency exchanges.

- High fees for small trades: Coinbase's fees can be high for small trades, making it less suitable for traders who are just starting out.

- Limited customer support: Coinbase's customer support has been criticized for being slow and unresponsive.

Supported Cryptocurrencies

Coinbase supports a wide range of cryptocurrencies, including:

Coinbase supports a wide range of cryptocurrencies, including: - Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Bitcoin Cash (BCH)

- Ethereum Classic (ETC)

- Dogecoin (DOGE)

- USD Coin (USDC)

- Tether (USDT)

- Chainlink (LINK)

- Uniswap (UNI)

Trading Tools and Features: Coinbase Trading

Coinbase provides a comprehensive suite of trading tools and features designed to empower traders of all levels. These tools include:

Coinbase provides a comprehensive suite of trading tools and features designed to empower traders of all levels. These tools include: - Real-time market data and charting

- Technical indicators and drawing tools

- Stop-loss and take-profit orders

- Advanced order types

- Margin trading

Technical Indicators

Technical indicators are mathematical calculations that analyze historical price data to identify trends and patterns. Coinbase offers a wide range of technical indicators, including moving averages, Bollinger Bands, and relative strength index (RSI). Traders can use these indicators to identify potential buy and sell signals, as well as to confirm existing trends.Drawing Tools

Drawing tools allow traders to mark up charts with lines, shapes, and annotations. This can be helpful for identifying support and resistance levels, as well as for plotting potential trading strategies.Stop-Loss and Take-Profit Orders

Stop-loss and take-profit orders are essential risk management tools. Stop-loss orders automatically sell a cryptocurrency when it reaches a predetermined price, limiting potential losses. Take-profit orders automatically sell a cryptocurrency when it reaches a predetermined price, locking in profits.Advanced Order Types

Coinbase offers a variety of advanced order types, including limit orders, market orders, and stop orders. These order types give traders more control over the execution of their trades.Margin Trading

Margin trading allows traders to borrow funds from Coinbase to trade cryptocurrencies. This can amplify both profits and losses, so it is important to use margin trading with caution.Security and Regulation

Coinbase takes the security of its users' assets very seriously. The company has implemented a number of measures to protect its users' funds, including:

- Two-factor authentication (2FA): 2FA adds an extra layer of security to your Coinbase account by requiring you to enter a code from your phone or email in addition to your password when you log in.

- SSL encryption: Coinbase uses SSL encryption to protect your data when it is transmitted between your computer and the Coinbase website.

- Cold storage: Coinbase stores the majority of its users' funds in cold storage, which means that they are not connected to the internet and are therefore less vulnerable to hacking.

Regulatory Compliance

Coinbase is a regulated money services business (MSB) in the United States and other jurisdictions. This means that Coinbase must comply with a number of regulatory requirements, including:

- Anti-money laundering (AML) and know-your-customer (KYC) regulations: Coinbase must collect and verify the identity of its users and monitor their transactions for suspicious activity.

- Bank Secrecy Act (BSA) reporting: Coinbase must report certain transactions to the Financial Crimes Enforcement Network (FinCEN).

Insurance

Coinbase is insured by Lloyd's of London for up to $320 million in the event of a security breach or theft.

Remember to click bingx exchange to understand more comprehensive aspects of the bingx exchange topic.

Fees and Payment Methods

Coinbase, as a cryptocurrency exchange platform, charges fees for various trading activities. Understanding these fees and the accepted payment methods is crucial for traders.

The fees on Coinbase vary depending on several factors, including the trading method, payment option, and market conditions. Let's delve into the details of each aspect.

Trading Fees, Coinbase trading

- Maker-Taker Fees: Coinbase employs a maker-taker fee model. Makers are traders who add liquidity to the market by placing limit orders that don't immediately execute. Takers are traders who remove liquidity by placing market orders that execute instantly. Makers typically pay lower fees, while takers pay higher fees.

- Fixed Fees: For certain trading pairs, Coinbase charges a fixed fee per trade. This fee is usually a flat percentage of the trade value.

Payment Methods

- Bank Transfers: Coinbase supports bank transfers as a payment method. These transfers are typically free or have low fees, but they can take several business days to complete.

- Debit/Credit Cards: Coinbase accepts debit and credit cards for instant purchases. However, these methods usually incur higher fees than bank transfers.

- Cryptocurrency Deposits: Traders can deposit cryptocurrencies into their Coinbase accounts and use them to fund trades. There are no fees for depositing cryptocurrencies, but there may be fees for withdrawing them.

Factors Influencing Fees

- Trading Volume: Higher trading volumes can result in lower fees, as Coinbase offers volume discounts to active traders.

- Market Conditions: Market volatility and liquidity can impact fees. During periods of high volatility, fees may be higher due to increased trading activity.

- Account Level: Coinbase has different account levels, each with its own fee structure. Higher account levels typically have lower fees.

Customer Support

Coinbase offers a range of customer support options to assist users with any issues or inquiries they may have. These options include:

Contacting Coinbase Customer Support

To contact Coinbase customer support, users can:

- Submit a support ticket through the Coinbase website or mobile app.

- Send an email to support@coinbase.com.

- Call the Coinbase support hotline at +1 (888) 908-7930.

Examples of Coinbase Customer Support Resolutions

Coinbase customer support has a proven track record of resolving user issues effectively. Some examples include:

- Assisting users with account recovery and security concerns.

- Providing guidance on trading and investing in cryptocurrencies.

- Resolving technical issues related to the Coinbase platform.

Obtain a comprehensive document about the application of best wallet for crypto that is effective.