Cryptocurrency Market Dynamics

Crypto bubble - The cryptocurrency market has experienced significant growth in recent years, driven by a combination of factors. These include the increasing adoption of cryptocurrencies as a form of payment, the development of new blockchain technologies, and the growing interest from institutional investors.

Historical Cryptocurrency Bubbles, Crypto bubble

The cryptocurrency market has experienced several bubbles in the past. The most notable of these was the 2017 bubble, which saw the price of Bitcoin rise from around $1,000 to over $20,000 in a matter of months. This bubble eventually burst, and the price of Bitcoin fell back to around $3,000.

Understand how the union of dash2trade can improve efficiency and productivity.

Impact of Media and Social Media

The media and social media have played a significant role in the growth of the cryptocurrency market. Positive media coverage has helped to increase awareness of cryptocurrencies and attract new investors. Social media has also been used to spread information about new cryptocurrencies and to create a sense of community among investors.

Finish your research with information from impt token.

Characteristics of a Crypto Bubble

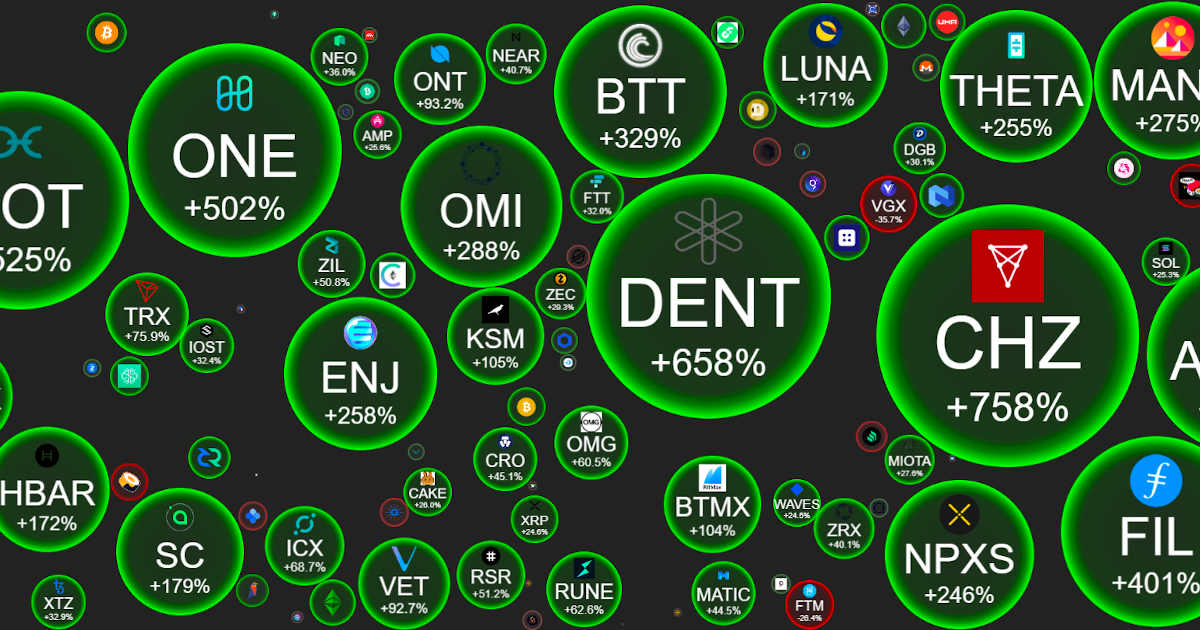

Cryptocurrency bubbles are characterized by a rapid and unsustainable increase in the price of a cryptocurrency, followed by a sharp decline. These bubbles are often driven by speculation and hype, rather than by fundamental factors such as the underlying technology or the adoption of the cryptocurrency.

There are several key indicators that can signal a cryptocurrency bubble. These include:

- A rapid increase in the price of the cryptocurrency, often with little or no fundamental news to support the rise.

- A high level of trading volume, with many new investors entering the market.

- A lot of positive news and hype surrounding the cryptocurrency, often fueled by social media and other online platforms.

- A lack of understanding of the underlying technology or the economics of the cryptocurrency.

- A high level of leverage, with investors borrowing money to buy the cryptocurrency.

Cryptocurrency bubbles can be compared to traditional asset bubbles, such as the stock market bubble of the 1990s or the housing bubble of the 2000s. However, there are some key differences between the two. Cryptocurrency bubbles are often more volatile and can burst more quickly than traditional asset bubbles. This is because cryptocurrencies are a new and unregulated asset class, and there is less information available about them.

Some examples of cryptocurrencies that have experienced bubble-like behavior include Bitcoin, Ethereum, and Dogecoin.

Risks and Consequences of a Crypto Bubble

Investing in a cryptocurrency bubble carries significant risks, including the potential for substantial financial losses, market volatility, and regulatory uncertainty.

When a cryptocurrency bubble bursts, the value of the underlying assets can plummet, resulting in significant losses for investors. The volatility of the cryptocurrency market can also lead to rapid price fluctuations, making it difficult for investors to predict the value of their investments.

Impact on Investors

The bursting of a cryptocurrency bubble can have a devastating impact on investors. In 2018, the value of the cryptocurrency market fell by over $700 billion, leading to significant losses for many investors.

Do not overlook the opportunity to discover more about the subject of free crypto mining.

The volatility of the cryptocurrency market can also make it difficult for investors to make informed decisions about their investments. The rapid price fluctuations can make it difficult to predict the value of a cryptocurrency, and investors may find it challenging to determine when to buy or sell.

Impact on the Wider Financial Market

The bursting of a cryptocurrency bubble can also have a negative impact on the wider financial market. The volatility of the cryptocurrency market can lead to increased risk aversion among investors, which can lead to a decrease in investment in other asset classes.

In addition, the collapse of a cryptocurrency bubble can damage the reputation of the cryptocurrency industry and make it more difficult for legitimate cryptocurrency projects to raise capital.

Case Studies

There have been several notable examples of cryptocurrency bubbles that have burst. In 2013, the value of the cryptocurrency Bitcoin fell by over 80% after reaching a peak of over $1,000.

In 2018, the value of the cryptocurrency market fell by over $700 billion after reaching a peak of over $800 billion.

Strategies for Identifying and Avoiding Crypto Bubbles

Recognizing and avoiding cryptocurrency bubbles is crucial for investors seeking to protect their assets. By employing appropriate strategies, individuals can minimize the risks associated with investing in volatile crypto markets.

Recognizing and avoiding cryptocurrency bubbles is crucial for investors seeking to protect their assets. By employing appropriate strategies, individuals can minimize the risks associated with investing in volatile crypto markets. Identifying Potential Cryptocurrency Bubbles

Identifying potential cryptocurrency bubbles requires a comprehensive approach that considers various factors. These include:- Excessive Price Increases: Rapid and sustained price surges, often driven by speculation and FOMO (fear of missing out), can indicate a potential bubble.

- Low Trading Volume: When prices rise rapidly but trading volume remains low, it suggests that the price increase is not supported by genuine demand.

- Media Hype: Excessive media attention and positive news coverage can create a herd mentality, leading to overvaluation.

- Lack of Intrinsic Value: Cryptocurrencies that lack clear use cases or underlying assets may be more susceptible to bubbles.

- Technical Analysis: Chart patterns, such as parabolic curves or head-and-shoulders formations, can sometimes indicate bubble-like behavior.

Conducting Due Diligence on Cryptocurrencies

Before investing in any cryptocurrency, thorough due diligence is essential to assess its potential risks and rewards. This includes:- Researching the Project: Understand the purpose, team, technology, and roadmap of the cryptocurrency.

- Examining the Whitepaper: Analyze the technical details, use cases, and potential value proposition of the cryptocurrency.

- Monitoring Market Sentiment: Pay attention to news, social media, and community discussions to gauge public sentiment and identify potential red flags.

- Consulting Experts: Seek advice from financial advisors, crypto analysts, or other experts who can provide insights into the market.

- Investing Cautiously: Start with small investments and gradually increase your exposure as you gain confidence in the cryptocurrency.

Assessing the Risk of a Cryptocurrency Bubble

To assess the risk of a cryptocurrency bubble, various methods can be employed:| Method | Description | Advantages | Disadvantages |

|---|---|---|---|

| Historical Analysis: | Comparing current market conditions to previous bubbles in the crypto or other asset classes. | Provides context and historical perspective. | May not accurately predict future behavior. |

| Technical Indicators: | Using technical analysis tools to identify overbought or overvalued conditions. | Can provide objective signals. | Relies on historical data and may not account for all factors. |

| Fundamental Analysis: | Evaluating the underlying value of the cryptocurrency based on its use cases, team, and technology. | Provides a long-term perspective. | Can be subjective and difficult to quantify. |

| Sentiment Analysis: | Analyzing public sentiment through social media, news, and other sources to gauge market enthusiasm. | Can identify potential bubble-like behavior. | May not accurately reflect actual market conditions. |

| Risk Management Strategies: | Implementing stop-loss orders, diversification, and other risk management techniques to minimize potential losses. | Protects against extreme price fluctuations. | May limit potential profits if the bubble continues. |

Long-Term Implications of Cryptocurrency Bubbles

Cryptocurrency bubbles have significant long-term effects on the development of the cryptocurrency market and the adoption of blockchain technology. Bubbles can damage the reputation of cryptocurrencies, making investors hesitant to participate in the market. This can slow down the growth of the cryptocurrency market and limit the adoption of blockchain technology.

Cryptocurrency bubbles have significant long-term effects on the development of the cryptocurrency market and the adoption of blockchain technology. Bubbles can damage the reputation of cryptocurrencies, making investors hesitant to participate in the market. This can slow down the growth of the cryptocurrency market and limit the adoption of blockchain technology.